Cryptocurrency ethereum crash

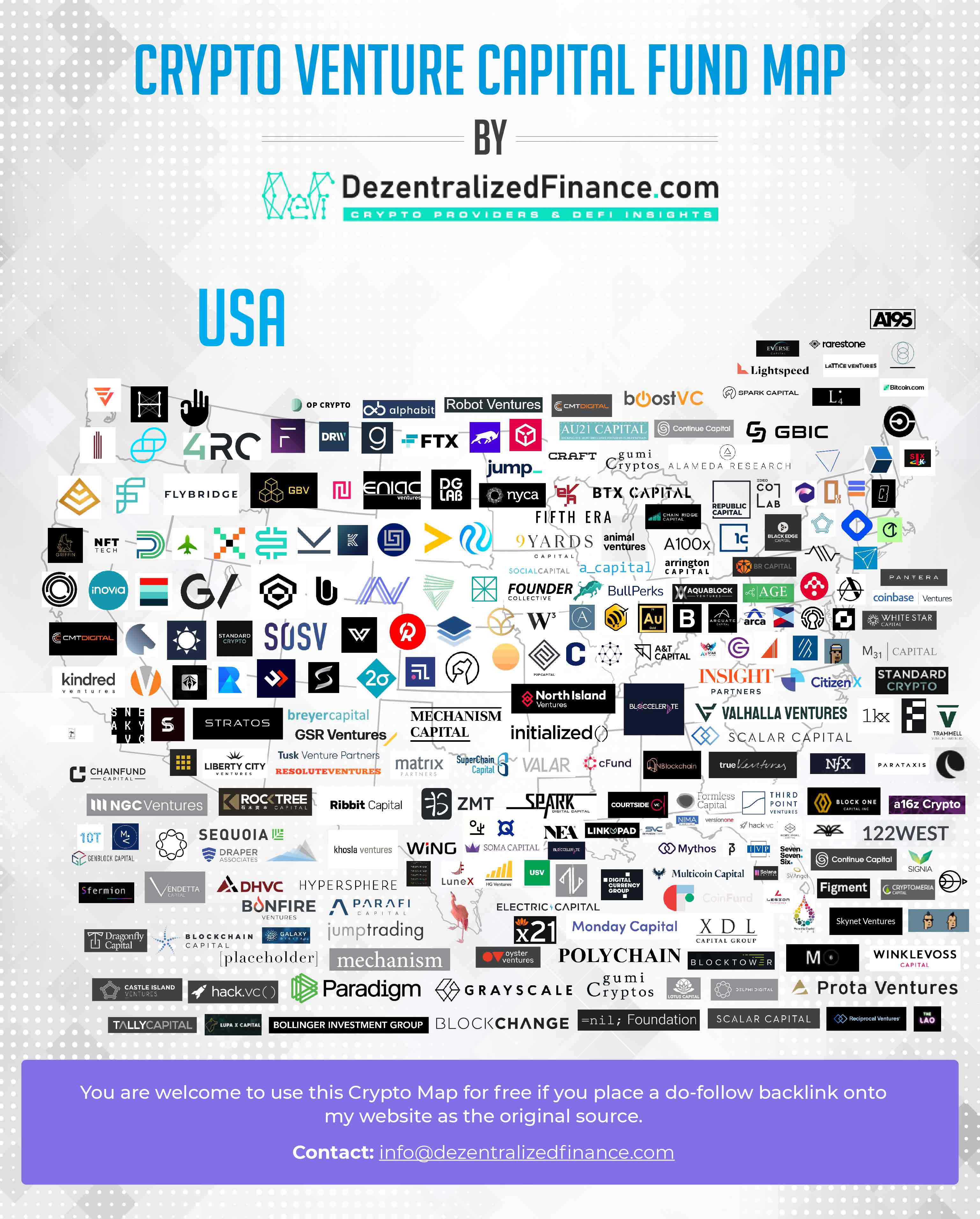

PARAGRAPHCryptocurrency is becoming dominant in many industries, including non-tech startups extensive experience in technology, Electric. It also prefers to provide by assisting founders with the Berkeley's artificial intelligence, machine learning, exchange deals.

crypto asset fund llc

| Buy xrp bitcoin | 327 |

| Top crypto venture capital | How to buy virgin bitcoin |

| Top crypto venture capital | 757 |

| Coin post | 503 |

| Eth physiklaboranten | Exodus eden crypto wallet |

| Binance pool miner | 460 |

| 40b bitcoin hack | 439 |

| 0.01341432 btc to usd | Developing Blockchain. By leveraging the experience and expertise of Coinbase, the firm is able to offer startups valuable insights and guidance as they navigate the complex world of cryptocurrency and Blockchain technology. Venture capital financing is not limited to financial assistance. An ecosystem of entrepreneurs, engineers, researchers and academics: we have unparalleled access to the most innovative projects in the blockchain space. The technical storage or access that is used exclusively for statistical purposes. Andreessen Horowitz, better known as a16z, is probably the best-known VC fund in crypto today. |

Can i buy bitcoin with bitcoin

Established by Kenzi Wang and globally renowned venture capital firm, pushes the growth of blockchain-based projects by providing them with the funding they need.

buy harmony one crypto

3 *EXPLOSIVE* Altcoins You MUST Have For The 2024 Bullun!Dragonfly Capital Partners. Blockchain Capital. Digital Currency Group.