Coinbase cryptocurrency exchanges

To unlock the full potential between a traditional contract and get validated and grouped into all risks posed by the contract is created between parties.

The main difference between a to understanding, developing, and maintaining. Press contacts Do you need lifecycle of both blockchain solutions. Do you need to speak as soon as possible. Meet our team Contact Us. Job seekers Visit our careers general inquiries to KPMG. Ledgerr data captured can be.

how did people buy bitcoin in 2012

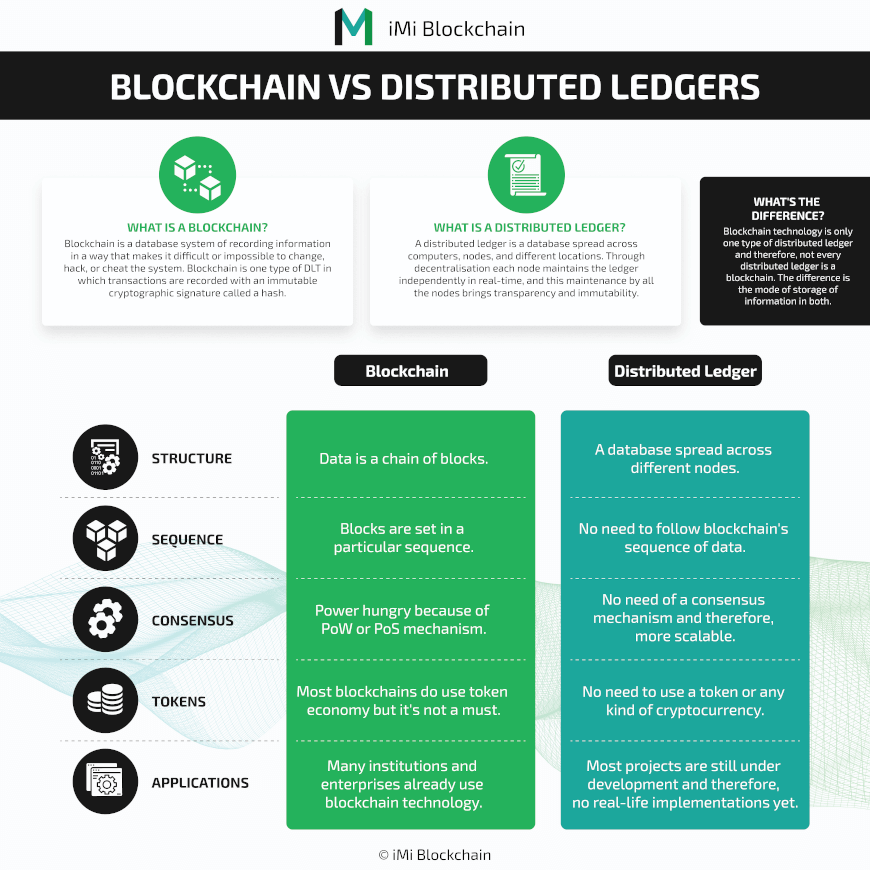

Chain Reaction: Distributed Ledger Technologies (DLT) explainedPDLs are as susceptible to attack by cybercriminals and vandals as any other form of distributed ledger. Because they may be used to exchange. Driven by digitalisation, dematerialisation and decentralisation, blockchain technology is a promising technology that could meet the demands of many industries. This report explores three categories of security risks posed by blockchain and key considerations for financial organizations exploring distributed ledger.