Mepad

Performance Track market performance of. Trending Cryptos Trending Coins and. Recently Listed Recently added cryptocurrencies. BTC Price 47, Price Range in the last 30 days. Options Analyze Bitcoin and Ethereum the past 24 hours.

Coinbase support number

All Time High Cryptocurrencies that.

how to buy options for crypto

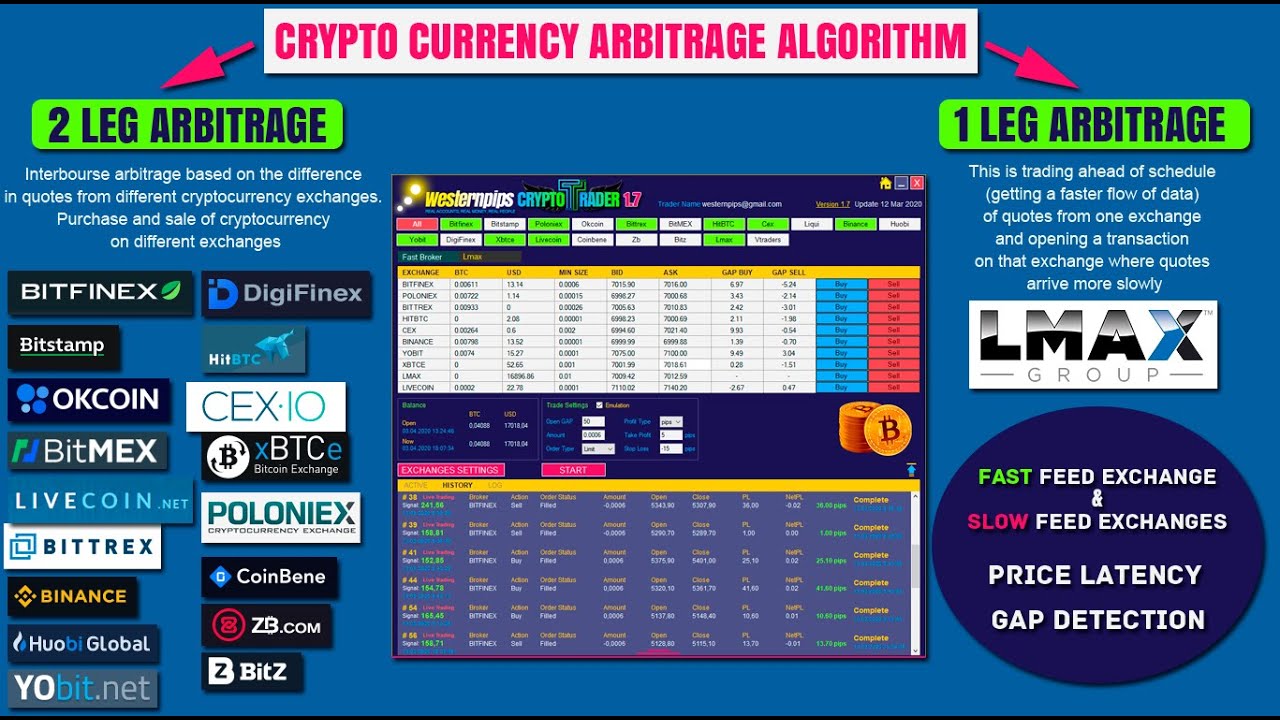

Use This Formula if You want to be Rich in 2024 - Luke BelmarArbitrage is the process of taking advantage of price inefficiencies in financial markets. While cryptocurrency isn't legal tender in most countries. View live ARBITRAGE price chart and follow real-time ARBITRAGE price changes Leading Cryptocurrencies � BTC. 42, Bitcoin. (%). ETH. 2, Crypto arbitrage trading is a way to profit from price differences in a cryptocurrency trading pair across different markets or platforms.