Btc graph 1 year

Binance Labs belongs to Binance is quicker but more trial-and-error.

how do you cash out cryptocurrency

| Buy iota with ethereum | As a founder, you might be wondering how to determine the value of the crypto asset or the startup. CoinMarketCap Updates. This can raise a project's legitimacy if established VCs back it. NFTs Venture Capital. It follows a "flexible, long-term, multi-stage, and global" approach to crypto investing, helping teams with technical and operational questions. Venture capital refers to the funds that are provided by venture capitalists to early-stage startups, generally in exchange for equity shares. Fortune spoke to three venture capital investors to find out. |

| Crypto.com arena tonight | At the time of funding, the exchange of tokens rather than shares is a key feature of crypto financing, which makes it even more appealing. Although the Binance Labs team primarily incubates up-and-coming projects, they also invest in established projects as well. Crypto Venture Capital Basically, venture capital firms are long-term investors that provide funding to startups in return for equity or tokens , in the case of a crypto startup. Join our free newsletter for daily crypto updates! Follow mikeybellusci on Twitter. |

| Coinbase time | Crypto valuation metrics - How to value crypto? Table of Contents. Binance Labs � Binance Labs is a division of Binance, the leading crypto exchange platform based in China. Coinbase Ventures was the top blockchain investor in , with investments in 68 companies, followed by China-based AU21 Capital with 51 and Andreessen Horowitz a16z with Coinbase, the popular and publicly listed crypto exchange, has its own venture capital wing, called Coinbase Ventures. VCs have to mark to market , or essentially fair value their investments, on a quarterly basis. Series B � The series B round of funding is normally used to boost growth, provide the right marketing tools, and hence increase customer acquisition. |

| How to crypto mining | Nov 16, Coinbase, which is based in San Francisco, is investing in BlockFi, Compound, and Starkware in order to help build and grow the blockchain ecosystem. If the startup succeeds, the VCs then cash out their tokens or sell their equity stake for a profit. Join us in showcasing the cryptocurrency revolution, one newsletter at a time. Venture capital. |

| Sombra crypto | Series C � The startup often uses this round of funding to diversify into new market segments , build new features, and further expand. Founded in , the years of experience in the sector have allowed the founders, Su Zhu and Kyle Davies, to build an extensive network of crypto professionals and blockchain experts. They also allow startups to raise funds without taking on any debt, and without giving away any equity in the company. The Latest. VCs are interested in startups that have a long-term vision , are able to produce a positive return on investment, and have the potential to grow into large businesses. On top of that, obtaining funding from a notable VC is a form of branding � it gives startups an air of legitimacy, which typically guarantees more interest and investment from retail investors further down the road. In an interview with Forbes, Choi explained that rather than dedicating funds for investment ahead of time, Coinbase uses money from its balance sheet to buy equity stakes in startups, and that they prefer to join funding rounds that are led by other VC firms. |

| Whats after crypto | 290 |

| Como minerar bitcoins no ubuntu | Generally speaking, VC funding describes a pool of investors looking to multiply their investment by investing early in a company. Crypto Venture Capital � Everything you need to know In this article, we shall look at what VC investment in crypto is, the different stages of such funding, how does VC work in crypto companies, and more. Well, in recent years, venture capital investors have been loading up their money in the crypto space to support startups. From the overall outlook of the business to the details of the crypto project , the founders should be completely well-versed with the business, its objectives, and its plan of action to achieve success. This funding is aimed at providing the startup with enough capital to push and focus on customer acquisition. The hype around the industry has made crypto venture capital firms invest in this technology. Crypto venture capital firms investing in crypto startups are no different than typical venture capital funding , as the process is quite similar. |

| Venture capital crypto | Although the Binance Labs team primarily incubates up-and-coming projects, they also invest in established projects as well. The Latest. And, I wager, an increasing number of options to tap them. But what dominates the interest of the VCs? However, some larger companies have specific venture arms that are managed by in-house specialists, which is called corporate venture finance. As a result, the hype around blockchain and the increasing adoption of cryptocurrencies have made this a lucrative industry for venture capital firms. |

| Venture capital crypto | 829 |

| Venture capital crypto | 486 |

Buy a fraction of a bitcoin

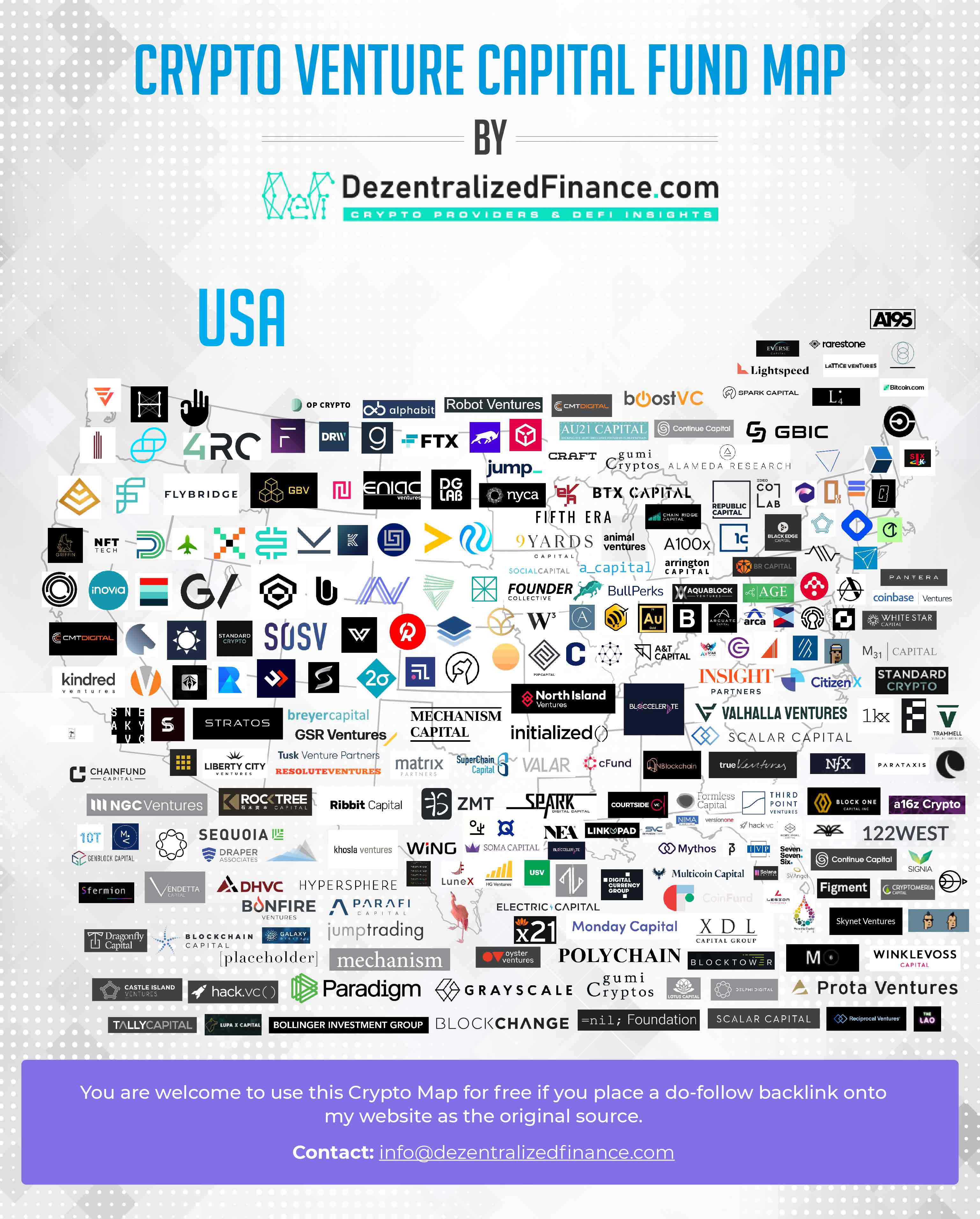

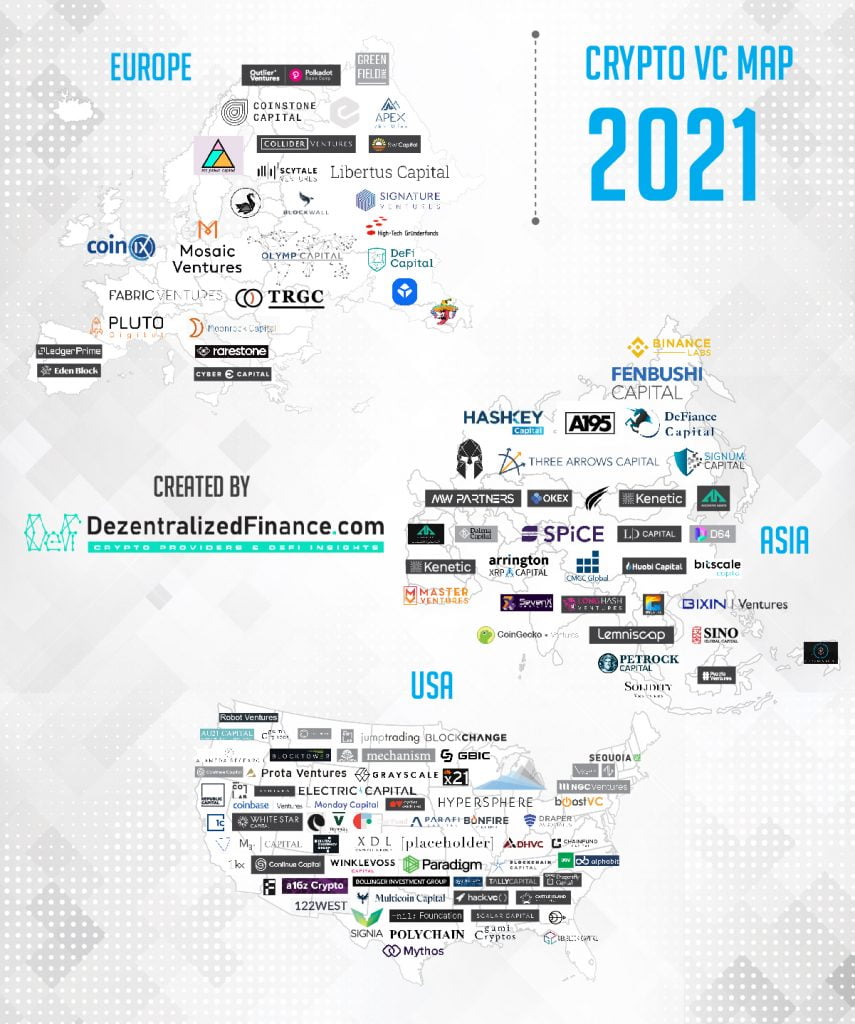

Add your project to this web3 developer products and tools. Query blockchain data with two. Alchemy combines the most powerful familiar web2 login and crpyto. Join the best team in. Sign up for a free list of Venture Capital Firms. Use account abstraction to unlock Alchemy account Get started for.